Perch "The Thoughtful Pause Podcast"

Welcome to the Perch Podcast Channel: The Thoughtful Pause Podcast

Perch stands for Pause, Evaluate, Responses to Circumvent Harm, a philosophy inspiring meaningful conversations. Hosted by Tricia Porter and Toby Malbec, seasoned business professionals and life partners, this podcast blends decades of expertise with a mission to foster understanding. Guided by the belief that where you sit determines what you see, and what you see determines what you do, they explore how experiences shape perspectives and how expanding our worldview fosters empathy.

From different races, worlds, and viewpoints, Tricia and Toby tackle complex topics with curiosity and a commitment to positive change. Unafraid of controversy, they challenge listeners to embrace a higher perspective and see differences as opportunities for connection. Whether seeking personal growth or a fresh lens on life, Perch is more than a podcast—it’s a mission. Join us to pause, reflect, and rise to higher ground.

Perch "The Thoughtful Pause Podcast"

From Boomers to Gen Z Part 2 - Navigating Generational Wealth: Housing Crisis, Retirement, and Financial Ideologies

Is homeownership out of reach for Gen Z? Discover the drastic shifts in housing affordability, generational wealth disparities, and how evolving ideologies around education and debt shape today's financial struggles, with a focus on systemic issues and the racial wealth gap.

Remember, your Perch isn’t just a place to sit; it’s a place to seek a higher perspective.

Welcome back Purchasoids.

Speaker 2:It's a great day Purchasoids.

Speaker 1:Purchasoids yes.

Speaker 2:All right.

Speaker 1:It's a great day in northern Michigan. Good to have you all with us again. As you may recall from our last conversation, we were really talking about the challenges facing the next generation, and did we leave them in the soup? Did we make a mess? And the answer is partially yes. The answer is is partially no. But how are you doing today? Tree?

Speaker 2:I'm well, toby, how are you?

Speaker 1:I am fantastic. We're rocking the detroit tigers jersey today. Uh, as we know, the detroit tigers are perennial seller dwellers, but we love them anyway up here in. God bless them, little puddings anyway. So, uh, what we're going to talk about today is one of the major topics we want to talk about is is wealth actually decreasing as we're getting into other generations and we were just talking about this before we even started filming and it's really not true that wealth is actually decreasing. What we're finding is in in some cases it's career choices, and in some cases it's just that the gap Now don't say we, that's what you found.

Speaker 2:All right, you don't know. If that's what I found, that's true, that's your opinion.

Speaker 1:What we're finding, though, is that the cost of living in general is going up faster than people are making money. So the one I wanted to start with if you're good with it was housing. Can we start there? Okay, absolutely. So let's talk about this a little bit. We hear about it and Tree said this on the last podcast. Both she and I have children who are millennials. Right, is that what we said?

Speaker 2:No no.

Speaker 1:Gen X, z, gen Z. Okay See, I don't even keep these.

Speaker 2:Gen.

Speaker 1:X is me. Ah, okay, so Gen Z. So one of my, my son, is in the, is in the workforce, my daughter just getting there, and both of them look at it and say, dad, you know, housing is just ridiculously expensive, you know can't afford to buy a house. And you look at it and say, well, wait a minute, how could, how could we have done it? Because I look at salaries and I say, you know, my son makes more at his age than he did when I was his age. So what's happened? So let me give you a couple quick numbers and then we'll we'll jump into the conversation so I'm sure our numbers aren't the same in 19 in the median household income 1984.

Speaker 1:So I got out of college in 85. So 84, the median household income. You want to guess?

Speaker 2:$25,000.

Speaker 1:$22,420. If the price is right, you would have been over. You would have lost, so sorry.

Speaker 2:But it's not.

Speaker 1:It's not so, you're okay, all right. $22,400. An average house what? Okay, all right $22,400.

Speaker 2:An average house. What did an average house in 1984?

Speaker 1:cost. What did we just do? What did I just give you?

Speaker 2:You just gave me a household income. Oh, household income, that's what you gave me $22,420 was household income. What was the house?

Speaker 1:$35,000. Oh gosh, I wish $78,200. What's the median price for a house? Oh, what year? 1984. Oh, okay, so if you take 22, 420, and 78, 200, the ratio is about three and a half to one. Okay, three and a half household income to house cost. Okay, three and a half to one. Let's go to 2022. All right, 2022, median household income. Want to guess? You can't cheat, you're going to cheat.

Speaker 2:I can't cheat I can't cheat, you can't cheat.

Speaker 1:That's right $250,000. Oh, you wish. What did you just say you live in, maybe in pesos $350,000.

Speaker 2:What Median household income? Oh income. I thought you said house. I can't hear. Okay, let's start over.

Speaker 1:Please send your. Okay, I'm ready. Please send your money. Operators are standing by Median household income. Median household income $75,000. Very close once you actually pay attention to my question. $74,600. I said $75,000. I know that's why I said you're dangerously close. Oh my God, Down from whatever $1.2 million that you had a minute ago.

Speaker 2:Whatever?

Speaker 1:Okay, and now let's. Let's talk about the average house cost.

Speaker 2:Which is what I thought you said the first time. You know I have a radar where I tune you out. It's kind of hard to tune in just for a podcast, but I'm tuning in Tokyo, I'm here.

Speaker 1:So median household $250,000. $433,000. And therein lies the rub In 2022.

Speaker 2:2022, the average house cost.

Speaker 1:We made a huge jump because it was just 250,000. The average household cost median house cost 2022, $433,000.

Speaker 2:Okay, where are we going?

Speaker 1:So now, the gap is 5.8 to one. Okay, so while income went up very steadily, housing costs went up exponentially. And you got to ask yourself why. Why did this happen? Well, two things. One of them is you may remember the loose lending practices in the year 2000s where we were giving, basically, mortgages to anybody who had a pulse and then you had to bail out the banks. We had all kinds of challenges around that. And then you had to bail out the banks. We had all kinds of challenges around that. Was it too big to fail? You know all of that. And then after that we had super low interest rates. Super low interest rates. Then we didn't have enough inventory in the market, drove pricing up like crazy. So now the affordability index is a mess To you.

Speaker 2:So I'm going in a different direction. Shocking, I knew that was next and this is what I have to say about housing. So because we left, the first one was about different generations and where they fare.

Speaker 2:And we said we're going to talk about it from through the lens of housing. Well, 73 million baby boomers in the US. They retire in 2030, yet 45 percent listen to this of baby boomers have no retirement or savings. They're becoming homeless at a rate not seen since the Great Depression. So think about that when we get to the finger pointing, until we start in the last one, when we said, well, this is the biggest transfer of wealth. And, yes, that's true, yes, they are retiring, yes, that's that's going to pull on SSI.

Speaker 2:But you have to realize too, not only so here's a generation that, when we look at it from you know, pointing a finger says the biggest transfer, a wealth because they had it. But here's a generation that's going to work longer, that cannot retire. When they retire, 45 percent of them doesn't don't have any savings or retirement. But I have some more numbers that that, like literally took my breath away too. So so I'm going to break this down also Before I get into this. I also want to say there is a disparity, and I thought I had the notes for this and I may why don't you look for that for a second?

Speaker 1:Because I want to pile on that. I was just reading something the other day. I'm just turned 60 this year and so you start to look at things like how much money do I need to pile on that? I was just reading something the other day. I just turned 60 this year and so you start to look at things like how much money do I need to retire?

Speaker 1:And I heard an economist I think it could have been Susie Orman or somebody on one of the morning shows and they said that for you to retire comfortably at age 65, you should have about between $1.4 and $1.5 million, and that's up markedly in the last 10 years. And again why we talked about some of the inflation challenges and pricing demands. But the other thing they said is that what's the average 65-year-old got in savings and it was like $87,000. So that's a big gap from $87,000 to $1.4 million. So that speaks directly to your point, which is, while millennials or Gen Zs or Gen Xs or whomever can point the finger, we're going to have some real challenges here coming up pretty soon as the baby boomers start to retire and start to realize that they don't have enough money to retire and our life expectancies have just continued to increase.

Speaker 2:Well, another thing. It's two issues and I don't want it to sound like all doom and gloom, but I think you cannot change what you don't acknowledge. So some of this is just informational and these numbers don't sound good, but in 2022, this part sounds good In theory. In 2022, nearly 40 percent of US homeowners own their homes outright. According to the Census Bureau data in Bloomington, in total, thirty three point three million single family homes and condos were mortgage-free. That's a 31% increase compared to 25.4 million a decade ago. So that sounds great. That sounds hopeful.

Speaker 2:This is where I got a knot in my stomach. There's such a huge disparity that now let's talk about because we talked about the generations but the racial disparity 41 million African-Americans in the US is 12 percent. That's in 2021, which is 331 million 331 million On average. The numbers and this is according to NAR, and NAR is the National Association of Realtors Majority of those homeowners are of the 33% and I had the actual number somewhere right here are white. The numbers cannot be stated of african americans who own their homes. There is literally no data stating of their percentage of homeowners in america. What percentage of that is that are african americans?

Speaker 1:well, we've talked about this.

Speaker 2:That makes me wanna cry, because what that says is go back to how did this go? What does this have to do with generation and different generations? Well, historically in America, the reason why people have an issue with boomers is because of the money and historically in America, the biggest transfer of wealth, the way to earn wealth, is between education and home ownership. So if it's barely and I'll get to the numbers soon, I don't want to make this a race thing, because that's another podcast for a different day because it's such a disparity in the rate of home ownership for African-Americans but if we barely own our homes in a low percentage, and when we do, we never own them outright. So how do you ever close this?

Speaker 2:You got a racial wealth gap in the generations and racially, so, the numbers are so skewed, you know, and it makes me sad to know that numbers are so skewed, you know, and it makes me sad to know that, like, how can you make this up when there's no, there's no avenue to close these gaps?

Speaker 1:Well, not only that, but and we've talked about this on previous podcasts but think of it like a race, right? And if I start a mile ahead of you and we are both running at the same speed An hour later, guess what? I'm still a mile ahead of you, and that's unfortunately the world that we find ourselves in, or a lot of the numbers I see is that minorities are making up a minute of that hour, but that's just so slow. So some of the economists will say, oh, the black community income is increasing at 3%, whereas the white income is increasing at 4%. But remember, that's a percentage of where they started. So in reality, in real terms, minorities are actually falling further behind, because if I have a million dollars at 4% versus $25,000 at 5%, I'm still losing ground, and that's what's happening. So it's kind of a shell game what they're trying to describe.

Speaker 1:And generational wealth is the biggest challenge. You nailed it.

Speaker 2:And since I brought that up, I thought it's fair that I give the actual numbers. While in a US home ownership rate increased 65% in 2021, the rate of African-American lag significantly at 44%, has only increased 0.4 percent in 10 years. It is nearly 29 percent points less than white Americans at 72, representing the largest black white home ownership rate gap in decades. And then it goes on to say but this is what I want to say Black homeowners and renters are most cost burdened than any other racial group. Less than 10 percent of black renters can afford to to buy their typical homes. And the reason why I felt like bringing that up is because when we just gave the numbers previously about the historic high of home ownerships, people that have mortgage free, the reason that the article and you can look this up and I'll put the link on it from NAR, the National Association of Realtors they said the reason why that jumped significantly.

Speaker 2:Think about it. So when we were going through the pandemic, we were going through what we went through when we looked up and we saw that interest rates had fell in the twos. So all of these seniors that were close to the end of their mortgage, you know they got their low interest paid it off, you know, quick. So therefore, that's why home ownership actually owning a home outright, with no mortgage made this jump Well, which is great and that's fantastic. But they could do that because they had it and they were the number that actually had the savings, where most of the numbers are staggering with the percentage that we gave, that didn't have, like you said, 75,000 or less, even in savings, and then some don't have a savings at all. So, of course, when there's times when the market hits, you have to have money to make money. We say that all the time, you know you have to have money to take advantage of those things.

Speaker 1:So there was an interesting article when it was this published 2021, in Business Insider, called Millennials are the highest earning generation but hold way less wealth, which would seem like a contradiction in terms. I want to read to you a little bit. And the section that they call is called an affordability crisis and it says the cost of living increases have outpaced wage increases. Some services and goods have become way more expensive than others over the last 21 years, with costs for things like see if millennials and Gen Z think of these as important college tuition, health care and child care far exceeding our hourly wage hikes. The most recent pay scale index found that wages have increased by 19% in the United States since 2006. But when you factor in inflation, real wages have declined by 8.8%. That means that workers have less purchasing power than they used to.

Speaker 1:It's especially a problem for millennials, who have faced one economic woe after another. Two recessions before the age of 40 and a staggering student debt load, coupled with soaring living costs, have created an affordability index for the generation that's, even with six-figure earning, feeling broke. And we were talking about this before we started filming and Mark, who does our podcast, said you know, there's this delusional thought now that our educators are pushing that says, oh, you have to go to college, oh, you have to go to college, you have to go to college. And we're forgetting the fact that there are good vocational careers and there are other careers that perhaps don't need to go to college and we're actually saddling our kids with these massive student debts. And then we complain when they say I can't pay my student loans or they can't afford a car payment or these other things. Clearly, purchasing power has dropped almost 9% in the last 10, 15 years.

Speaker 2:Well, I'm going to say something, and I know I'm not saying this for argument's sake, it's just food for thought. I know the millennials aren't going to like it, I'm going to like it. But so all of those factors are true and all of that the financial burden was laid on, was handed down to them Unfair, unjust. I don't even believe in fairness. It's a different conversation. But generations before the millennials, we did have delayed gratification. We did Funny shit. I want to get into that. We had delayed gratification.

Speaker 1:We did Funny. You say that I want to get into that.

Speaker 2:We had delayed gratification. We came up. I promise you my car was the biggest hooptie on the planet. Like literally, I would just drive down the road and my lights would go. It shouldn't have been on the road. They went. What? Okay, like seriously, I mean cars would start honking because I had an electrical issue and I couldn't afford to get a fix.

Speaker 1:It shouldn't have been out there I had a car in college. You couldn't go reverse. Yeah, didn't go in reverse.

Speaker 2:That's what I'm saying, and I literally had rust spots and holes. I couldn't go through car wash because, you know, because it'll get wet Nevertheless. But each generation had a starter, everything. That's how we in America. You had a small house, we had 800, 900 square foot home and we stayed in there, not until we got this, until our families outgrew it, and then we went to a bigger home.

Speaker 1:I want to jump, I want to pile on that. Why is it different? Now Tell me why. I'm not going to tell you why I think it is, but you tell me why we put up with cars that didn't go in reverse or cars that went Because we weren't given anything, so we had to, because there was no expectation. But why did we put up with it and people today won't? Why were we willing to put up with it? Who is we Tato, we, we, we, we, we. Who Us Us? Is us usses? It clarified because we're talking about our generation was willing to drive cars it didn't go backwards or cars that went you missed your line again you know, whatever it was, okay, we put up with that.

Speaker 1:We lived in little homes, we didn't. But today they don't want to do that. And why don't they want to do that? Why don't they want to do that?

Speaker 2:you're missing your line, it's not the fact that, first of all, you're not saying it correctly. It's not the fact that we put up with it. That is not what it is. That was the only option we had. My mom used to call it duck or no dinner. That means you eat this duck or you don't eat shit. Nothing, that was all we had. So putting up with something meaning you have an option. When you put up with something, you put up with it because you have a choice.

Speaker 1:I'm putting up with something. You put up with it because you have a choice. I'm putting up with this, but I could leave.

Speaker 2:I have a choice. I couldn't roller skate to work because those were the only other wheels, so why is it different?

Speaker 1:today. Why is it different today? I'm going to give you one word.

Speaker 2:No, first of all, you're going to let me Okay, talk, I'm done to credit.

Speaker 2:So that's part. No, well, this is what I have to say to that. And I understand that. I think my generation was the first because right after the Obama came in and and really got after may change the laws where these creditors just couldn't inundate college campuses. I think that generation, what generation is it? Generation X was the first generation that literally saw you know these credit card companies like so as you get to college, here you go. So as you get to college, here you go. So it was there with generation X. But our generation, we saw the struggle. Most of us worked at a very young age.

Speaker 1:How old were you when you had your first credit card?

Speaker 2:That's a great question. I wouldn't take it. That's a whole other conversation for another day. I was in my 20s when I started using credit cards.

Speaker 1:What do you think today? What's the average age that somebody gets a credit card? I mean, you look at the average debt.

Speaker 2:I know my kids got them when I I mean well, got banking cards, which was credit cards too, and access. I think they were about 15.

Speaker 1:Right. But it wasn't that it wasn't, they weren't balling out, it was not a bet. I would argue that our culture has changed to the point where we are okay with being in debt. We're comfortable with being in debt, but Toby.

Speaker 2:I think that that's a disconnect, because I understand what you're saying, but where I think the bigger point. My point was where's the delayed gratification? Because you're putting it on credit cards.

Speaker 1:I'm putting it on credit, no Credit in general, whether it's you can get into this car today or you can buy this house, because of these subprime mortgages.

Speaker 2:Ideology, though I understand that.

Speaker 1:But I'm talking about ideology.

Speaker 2:Where did it come? Where we felt like you know, and I think our generation started it. I think our generation started it. I think our generation because we wanted them to have more and said when you graduate, you get a car, when you graduate, you get this. And the generation before them, if they got a car, it was the their parents car, that they old clunker and they were happy for like god, as long as it wasn't that station wagon with the brown wood.

Speaker 2:But even if you got that, it's better than roller skates, I'm telling you, than a bus pass. But so then we took that away and said, you know, we just, they started us off if they could not. Everyone got even a parent's car, I didn't, you know, but they started us off with what they had, because their thing is, you know, you earn your own. I'm giving you something to get you to point a, to point b. And then we came along and before some of the kids got in high school, my, my daughter we talked about this with our kids went to a school where a kid was given a g-wagon a mercedes g-wagon, like that's six figures, like what the in high school, that's irresponsible judging but not judging.

Speaker 2:So we came with that thing where we wanted our children to show they're my children, so if I have status they have to show status. That's on us, that's not them. But I'm saying, even when it came down to the starter homes, you know, most everyone I know started at 2,000 square feet or bigger. I don't know where anyone has started and that's the theory.

Speaker 1:I'm not saying that expectation. I guess what I'm trying to get at is that.

Speaker 2:But that's not a credit card.

Speaker 1:Well, but there's a number of things that have changed socially as well as financially, as we've seen that have created almost this perfect storm of expectation where you know our quality of life has improved, right, I mean, I guess you could argue we all live in. We saw last night we were watching that the baseball game and they said that you know, back in 1910, something like 15% of houses had toilets. I mean 1910, that wasn't that long ago and now our expectation is you're going to live in a house with air conditioning and you're going to live in a house, perhaps a garage, so many square feet. So our expectations have changed.

Speaker 1:I was about to get off topic Shocking. Our quality of life has improved, but it's also the cost of life has increased as well, and so one of the things I wanted to talk about is what do you think, as a country, we can do to try? What are some of the key things? If you were running for office, what were the two or three things you'd do to try to control the affordability crisis? How do we make housing more affordable? Let's start there. How would we make housing more affordable?

Speaker 2:I would, so this is my presidential speech.

Speaker 1:There you go.

Speaker 2:America come in. First of all, we need to revamp and yes, this is personal and I'm fine now but we really need to revamp our credit system, this FICO system, the way we do credit. It is unfair, it is unjust and imbalanced, and I'm going to give you a part. Why do you say that, tresha? I'll tell you because what it's, a system that says a lot of our structure and system in America is set up to award the reward the rich, and so FICO is another way.

Speaker 2:So they say if you're absolutely perfect, if you you know you have X amount in a bank and you do all this, never miss a payment, we're going to make it easy for you to get credit. So you're going to make it easier for the people who need credit the less, to get more credit. So for poor people who actually can't make it from day to day, who needs grace, grace is credit. Credit buys you time. For the people that need grace, you make it harder, you charge them more. So I pray America's listen. This system is broke and it's flawed, and it goes back to the last podcast we talked about Scott Galloway, but it goes back to his point of, like you know, so you put money into Social Security and you pay all of this in. If you have five, six, 10, 15, 20 million dollars, why are you taking down Social Security? You don't need it, so we need to create a system.

Speaker 1:You're not answering my question, I'm going to bring you back. I want actionable things In the last 20,. In the last 28 years, houses have gone from seventy eight thousand dollars, no, no. Stay with me. In the last 28 years, houses have gone from $78,000. No, no, stay with me. In the last 28 years, houses have gone from $78,000 to $433,000. How do we make them more affordable? I want actionable steps and I understand credit. Credit works for me.

Speaker 2:Because, first of all, they've got to be able to buy the house.

Speaker 1:How do we make housing cheaper?

Speaker 2:How do we make housing cheaper? What will make housing cheaper? How do we make housing cheaper? We start. What will make housing cheaper if we have more and Bishop TD Jakes is working on this too, where he's got a billion dollar funding with Wells Fargo to do more mixed income communities. What created this disparity is when we start saying I'm over here, you over there, this zip code is versus, you're next to me, and because we drew this line. So once we start having more mixed income communities, these and these properties will not appreciate at the level that they're going. We will have more balance and we'll have more affordability. But the minute where you say because I'm over here and I'm in this zip code, so that's where we can start, we can start saying how do we bring more unity, more diversity, more diverse incomes into communities? That's going to start. We need to get rid of redlining. I'll be here all day.

Speaker 1:It's a thousand things I can do. I just want to blood hammer them, because these are some interesting points there should not be Redlining should be unconstitutional.

Speaker 2:It should be against the law. You should not be able to draw a line in America and say, because you are of this race or this socioeconomic background, this line is drawn because I need to protect their property from yours. Until we start and this is not me just saying take from the rich and give to the poor. That's not what I'm saying.

Speaker 1:That's saying, let's erase all of these lines that separate us. To begin with, how do we get builders to start building low-cost housing as opposed to building high-cost housing? How do we incent lower cost housing? Because that's the challenge. I mean, I was in Toronto a couple of weeks ago and everybody's building high cost housing. How do we, how do we incent builders to build low cost housing to fix this, to lower this gap?

Speaker 2:But it goes back to saying there is a way. So they bought this up when it. When it came down to I hate to bring his name up again Scott Galloway, but when they were talking about the tax and revamping our tax code and our tax system, here's a thought. It's not like we're transferring wealth, but more people factually and I have this in my notes. I want to say this quickly. They brought this up in a podcast and they said that Simon Sinek bought this up and said he was like. I did a quick study. He was like Rockefeller, carnegie and a lot of the rich people who were rich during the Victorian era. There was no tax code. They didn't give incentives for them to give back. But everyone knows that, carnegie, you may have whatever issues you want to have with them, but there was philanthropy when there was no tax incentive. So I'm going somewhere. So these people were given being the Brits and Americans back in the Victorian days. And we know, carnegie, we still have Carnegie Hall and other places.

Speaker 1:Carnegie Deli yeah.

Speaker 2:No, I should tell you. So they gave even when there is no tax incentives, he goes. Why did they give? Because back then they felt that there was a moral obligation to say OK, now we're not, you're going to pay a little more, but you get to say where your money goes. I think that would change all of this. I think people that make more will be more amped to give when you say OK, you know what, I can have this as the Malbec Institute of whatever the case may be. You know what I can have this as the Malbec Institute of, whatever the case may be. Then we start changing the tax code, changing those things and giving people who pay more different initiatives to put their money to, and then we can start making changes, because now we can have home endowments and say you know what I want my money to go to? A lot of the deals with you know the plight of the homeless and all of these things, and that's, yeah, the Malbec Institute of Tomfoolery is what we're going to do.

Speaker 1:We tried to boil the ocean in the last two episodes two podcasts.

Speaker 2:We did a lot.

Speaker 1:We want to hear from you, give us some ideas of topics you'd like us to cover along this line, because there's a lot to cover as we try to really fix up some, some screwed up stuff, and some of it's our fault, some of it's not, some of it's, you know, technology running amok, some, some of it's just us not keeping up with what's going on. But, um, we, we appreciate you taking the time with us today, um, and we appreciate the feedback you guys always give us. And, uh, until we see you again.

Speaker 2:I do want to say until we see. I do want to say we do encourage you guys to subscribe, to join us, because, ideally, we're not just doing this to get numbers up. That's great. I really want to get to the point where we have a big enough following and support so we can have live conversations. I want to have live conversations because I want feedback. We really want to do what we can to be some kind of instrument of change and give everyone a voice. So that's important. So subscribe. I don't even like saying like us because I'm like like me, please, like me, but please and for those of you older people who don't know how to subscribe, because I had that happen too Like I keep pushing a button not the button you see on the screen and in YouTube, it's a button beneath that says subscribe and it'll give you a little bell. But yeah, we really want to go live. We really want your feedback, your participation. So until we meet again, we'll see you on the perch, take care.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

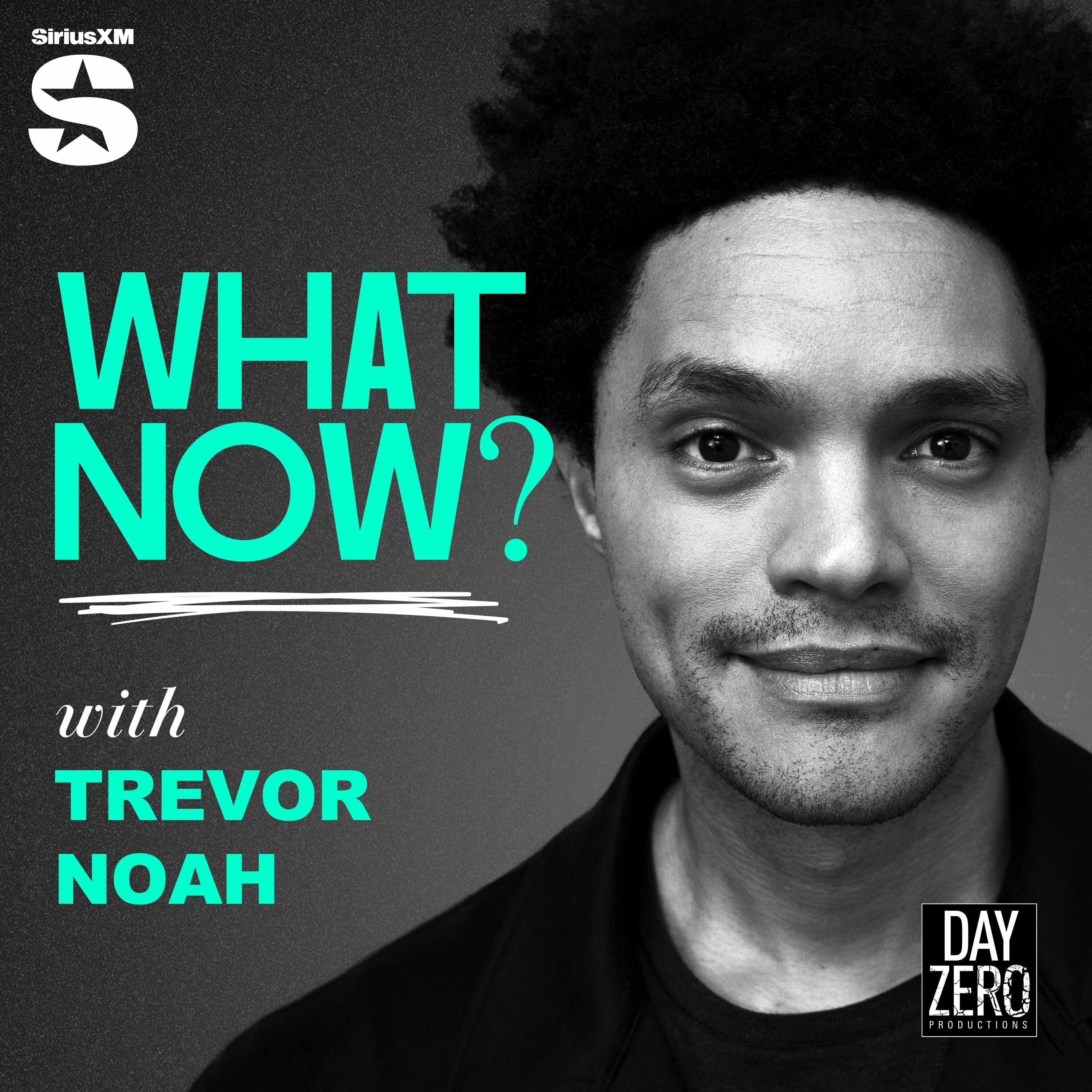

What Now? with Trevor Noah

Trevor Noah

The View

ABC News

A Bit of Optimism

Simon Sinek

Oprah's Super Soul

Oprah

Woman Evolve with Sarah Jakes Roberts

Woman Evolve

The Mark Cuban Podcast

The Mark Cuban Podcast

The Shop

UNINTERRUPTED